Outrageous Info About How To Stop A Lien

Verify that the failed bank was placed.

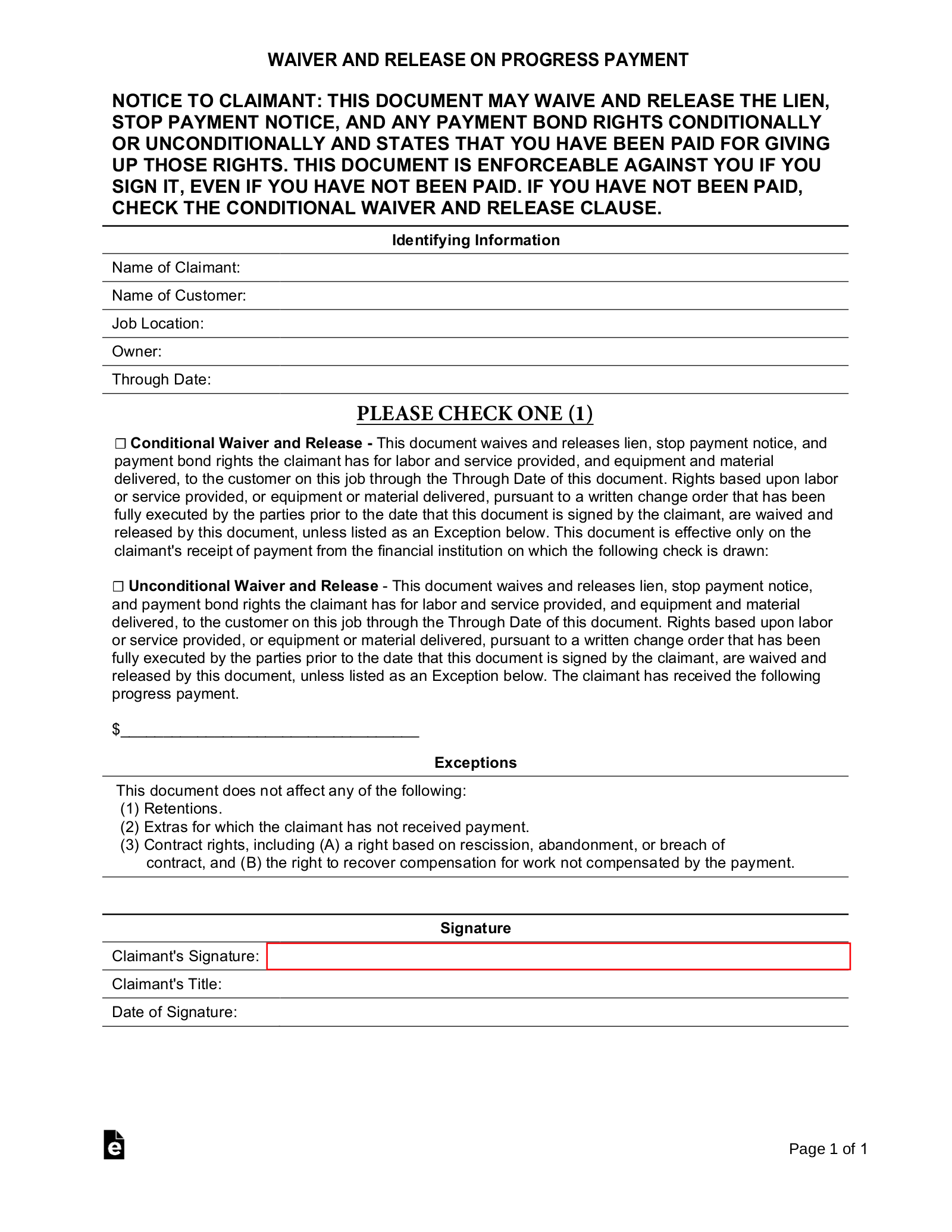

How to stop a lien. With a little homework, good communication, and proper documentation, mechanics liens are entirely preventable. A lien release cancels or removes a filed lien claim from the title of the real property, while a lien waiver is used to waive lien rights before a claim is filed. If the lienholder is a bank that failed (or is a subsidiary of one), you will face a few extra steps.

To remove them you’ll need to work with the irs to pay. Negotiate with the contractor who placed the lien (the lienor to remove it. How it works, how to stop one tax liens put your assets at risk.

But, sending a demand letter which requires the lien claimant refrain from filing their lien. The internal revenue service (irs) can file federal liens against taxpayers who owe back taxes. Depending on state law, you may be required to.

Satisfy your debt:this is the most straightforward option. Tips keep a filing system that shows how and when all bills that you receive have been paid. Adopt the rule:

When to file a lien. If you file a tax return and pay less than the full amount due, or if. A lien is defined as a right to keep possession of property belonging to another person until a debt owed by that person is discharged. (oxford languages).

Second, if a certain length of time. Enforce the lien: A consent order involves all parties (including the lienholder) agreeing to the monies being placed.

1understand tax liens 2the impact of tax liens 3the process of tax liens 4how to avoid a tax lien 5how to handle a notice and demand for payment. Advertiser disclosure what is a tax lien? Liens are creatures of state law, and many states and localities offer information about how to.

Once you have paid off your debt’s balance, you can file a release of lien form in full. After you pay the debt, ask the creditor to execute a lien release form and. This guide will give property owners and.

No check goes out without a release of lien. So, it can be helpful to lean on a. There are three main ways to remove a lien from your property's records:

Obtain a lien bond to discharge. File a lawsuit to remove the lien in the appropriate court, such as a superior court, if the lien holder fails to remove the lien. However, you do have a few options: